Featured Content

Browse by Topic

Recent News

3 questions to ask before pursuing debt relief

By: Aly Yale | Source: CBS News MoneyWatch

“If you have less than $5,000 in debt and a steady income, you should consider whether you can try to pay that off with a little discipline and mild sacrifice,” says Howard Dvorkin, chairman of Debt.com. “Debt relief programs aren’t free, because those experts you’re consulting need to earn a salary, too. So, it only makes sense if you have significant debt, you just can’t pay down on your own.”

Is debt relief the right option for you? Here’s what experts say

By: Aly Yale | Source: CBS News MoneyWatch

“Debt relief is a broad term, encompassing a number of solutions,” says Howard Dvorkin, chairman of Debt.com. “It’s kind of like asking, ‘What is a diet?’ There are as many ways to shed debt as there are to shed weight.”

Best places to save money and earn interest in 2024

By: Cassidy Horton and Ashley Barnett | Source: USA Today

“If you have access to a 401(k),” said Howard Dvorkin, chairman at Debt.com, “then that’s easily the most lucrative safe space for your hard-earned cash.”

How to cash a check without a bank account

By: Holly Johnson, Ali Cybulski & Adam McFadden | Source: CNN Underscored

“Start with the check’s issuing bank — the name of the bank printed on the check — if you need to cash a check without a bank account. For example, a check from someone who banks at Chase could be cashed at your local Chase branch, if one is available,” “The account needs to have enough money in the payer’s account to cover it, and the payee will need to show a government-issued ID to cash the check,”

As Loan Default Rates Remain Steady, Many Young Borrowers Are Unaware of What This Means

By: Hanneh Bareham | Source: Bankrate

“I can only speculate why defaults are suddenly up in this age group, but I wonder if student loans play a part,” “After three years of frozen payments due to the pandemic, October marked the thaw. Coupled with inflation, that could be the one-two punch that drove up defaults,”

Can You Pay Off a Personal Loan Early?

By: Laura Gariepy | Source: Credible

“First, [the lender] can charge you a percentage of your loan balance. That’s usually around 2%,” he said. “Second, they can charge you a flat fee. Or third — and worst of all — they can actually charge you all the interest you’re saving by paying early.” “You don’t have to think so big. You can also pay off your loan early by nibbling away at it every month.”

Have Credit Card Debt? Here’s Why You Should Pay More Than the Minimum Payment

By: Katie Teague | Source: CNET

“Credit card companies make more money when the minimum payment is lower, so more money goes towards the interest rate and less towards the principal,” “Every credit card company is mandated by law to give you the credit card agreement,” “When you pay late, credit card companies can hit you with higher interest rates that won’t drop,”

Alternative Ways To Pay If You Don’t Have a Credit Card

By: Jordan Rosenfeld | Source: Yahoo Finance

“The downside to prepaid cards is that they have fees for activating and transferring money on to them,” he said. “Generally speaking, they are good to have available as a backup option if you are intending to use cash for your purchases.” “But a secured credit card actually builds your credit,” he said. “Of course, you have to make timely payments, but it’s like a set of training wheels for your financial bicycle.”

On the brink of a financial abyss called bankruptcy: the disparities that keep Latinos from their goals

By: Yngrid Fuentes | Source: Noticias Telemundo

“Bankruptcy filings are increasing because three costly factors have converged. First, inflation may not be rising as fast as before, but it’s not going down either. The longer inflation persists, the weaker Americans’ finances become,” “Second, student loan payments that were frozen for three and a half years were unfrozen in October, meaning 45 million people suddenly owe hundreds of dollars a month. Third, with credit card interest rates at record levels (an average of 25%) it is no longer possible to use plastic to fill income gaps.” “Most of your credit score is determined by a simple measurement called ‘payment history.’ All that means is: ‘Do you pay your bills on time?’ ”

How to Save for a House When You Have Kids

By: Rachel Morgan Cautero | Source: What To Expect

“You’ll need to look over your budget — if you already have debt, you will need to be prepared to take on the additional debt of a mortgage, explains Howard Dvorkin, CPA and chairman of Debt.com. You will also want to monitor your credit score, which will help you secure a mortgage loan, and educate yourself on the overall costs of homeownership. This will include insurance, property taxes, utilities and maintenance.”

Tips for Trimming Monthly Housing Expenses

By: Jean Chatzky | Source: SavvyMoney

“Extended warranties are intentionally confusing and limiting,” he explains. “If that washing machine breaks? It might be chalked up to ‘regular wear and tear,’ which is rarely covered.” If extended warranties were such great deals, he reasons, why do salespeople push them so hard? “Obviously, they’re cash cows for everyone but you.”

Americans are approaching their credit card limits ahead of holidays

By: Sam Bourgi | Source: Credit News

You can’t get out of debt if you don’t understand what’s keeping you there,” Debt.com’s chairman Howard Dvorkin told Fox Business.

Browse by Topic

Recent Columns

What The “Next Recession” Experts Are Missing

By: Howard Dvorkin

It’s so obvious, why aren’t they mentioning it? I’ve previously predicted the next recession in 2018 although it won’t necessarily be Trumps fault.

3 Discouraging (And 2 Encouraging) Facts About Americans And Their Money

By: Howard Dvorkin

How are Americans and their finances? It’s complicated. There’s seldom good news about Americans’ debts. Can it get any worse? Sure it can.

In Defense Of Capitalism As A Way To Get Out Of Debt

By: Howard Dvorkin

I’ve created and operated businesses that help Americans climb out of crushing personal debt. If I’ve learned anything, it’s this…

3 Revealing Money Facts You Probably Haven’t Heard About

By: Howard Dvorkin

You probably haven’t heard about these revealing money facts. That’s why it’s so important that personal finance become not just a personal topic.

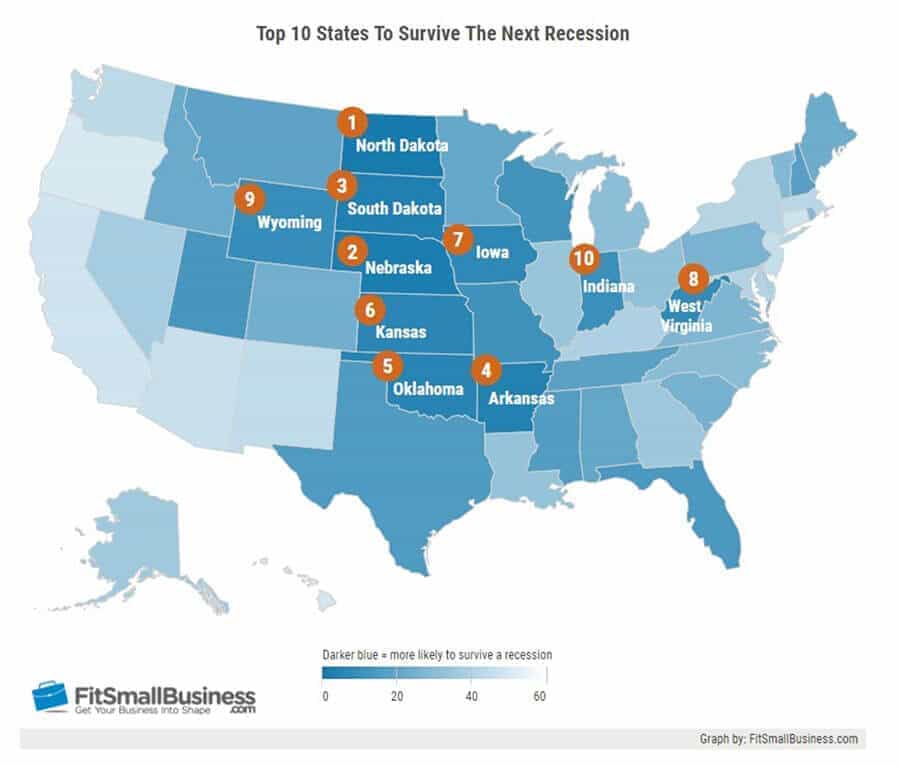

Who Exactly Will Survive The Next Recession?

By: Howard Dvorkin

College and NFL football seasons are well underway, and several notable upsets have already happened. What defines an “upset”?

Debt.com Scholarship Winner: Going To College While Teaching School

By: Howard Dvorkin

Holly Montsari graduated from college years ago, but now she’s going back to school while working in a school. Confused? Welcome to Montsari’s life.

Why 3 Obscure Polls Are Good News About America’s Debt

By: Howard Dvorkin

This marketing company spent four weeks interviewing 8,550 Americans. Conclusion: despite America’s debt, Americans love coupons,deals, and spending.

Will The Equifax Breach Be the Beginning Of Something Wonderful?

By: Howard Dvorkin

American businesses and citizens haven’t taken identity theft seriously, until now since the breach at Equifax, which might be a wonderful thing.

Car Insurance for Your Teen Will Drive You Crazy

By: Howard Dvorkin

Wonder how much it costs once your teenager starts driving? While we all complain about personal debt, we often forget that it’s not just personal.

What the Equifax Data Breach Means to Your Identity

By: Howard Dvorkin

When The Equifax data breach occured, 143 million Americans had their personal information exposed to identity theft. It’s complicated – and ironic.

Are Student Loans Going To Cause The Next Recession?

By: Howard Dvorkin

With more than $1.3 trillion in student loan debt, student loans are too big to fail. However, they might now be too big to succeed.

This Teenager Probably Knows More About Money Than You Do

By: Howard Dvorkin

Will Amouzou is 17, but he doesn’t aspire to be a sports star or movie star. He wants to be a chief financial officer. He’s our latest scholarship winner.